Introduction

Large sweeping pieces of legislation often makes for big news, especially after the 2022 Inflation Reduction Act (IRA) meant that the U.S was going to spend a historic amount of money towards the climate movement. From painstaking negotiations and compromises within the democratic party (mostly from fossil fuel loving Joe Manchin), to a 51-50 vote with democrats all for it and republicans all against it, 369 million dollars directly into tackling environmental issues is no small feat. Great news for us! But what often gets neglected is the analysis and debriefing of the effectiveness of said legislation, especially if the opposing party is known to take credit for these positive societal changes. Though my understanding of law, taxes, and anything involving spreadsheets and money is rudimentary, I hope to follow the money of the IRA and analyze its effectiveness.

Following the money

The federal government’s approach to tackling climate change can be summarized as pouring a truckload of money in front of local governments, businesses, and individuals and hoping that we use it effectively to bring down emissions by 40% of 2005 levels by 2030. My main questions though are, has the money been put to good use so far in 2023, roughly 1 year after the bill passed. What exciting new technologies and projects will come from it? And also, how is the U.S government with all their news and debates on national debt going to pay for it?

How is the Inflation Reduction Act being paid for?

The bill will be paid off by upcoming taxes and fees, mostly from fiscal policy changes that came with the IRA that would theoretically be able to generate $737 billion dollars. These policy changes from the IRA target large corporations that have historically avoided taxes through various loopholes. Now this to me is super interesting as getting big corporations to pay taxes is like trying to smash open a flying, teleporting piggy bank. Big corporations have the resources and brainpower to dodge coughing up their coffers with 55 of the U.S largest companies paying a big fat zero dollars in corporate income taxes in 2020. It’s like the federal government and big corporations are in a taxation arms race, much like doctors with antibiotics and resistant strains of diseases. Some strategies include 1% tax on stock buybacks, a 15% corporate minimum tax on corporations that average more than a billion dollars a year. There are no new taxes for businesses that earn less than $400,000 a year. Yay for small businesses then!

Experts are skeptical that a 15% corporate minimum tax would be effective as large corporations, especially tech companies, can still find loopholes through tax deductions, and write offs. However the other methods of raising revenue for the IRA such as the 1% stock buy back tax, and prescription drug pricing are seen as an inch in the right direction by democrats. Stock buybacks were illegal up until 1982 (dismantled under when Regean was in office, big surprise) as buying up your own companies stocks to inflate its value was considered to be market manipulation. Though the 1% tax on buybacks seems negligible, it is expected to generate $74 billion in revenue and the percentage may increase over time until it completely deters companies from purchasing buybacks.

Prescription drug pricing is expected to lower the absurdly high drug costs AND generate between $237- $265 billion dollars in government revenue. Our much beloved friend in the senate, Bernie Sanders, has already been busy with drug price negotiations. Though do note that a lot of these loopholes added to the IRA were added in by Sen. Sinema Sold out.

Where has the money been going?

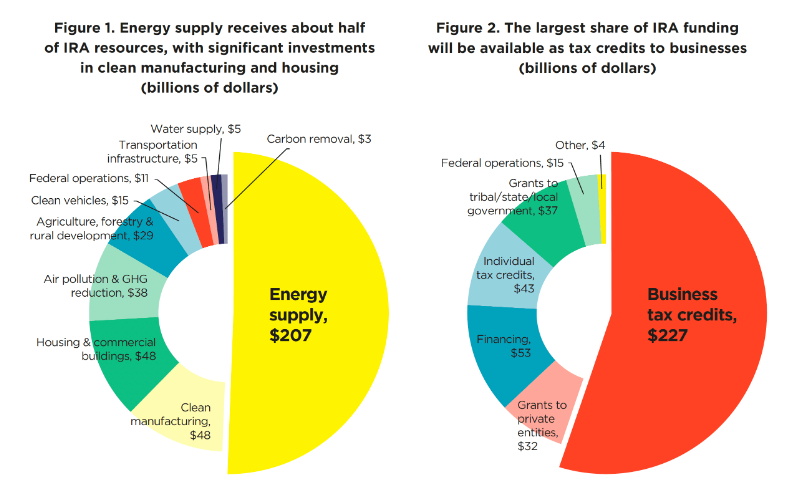

The biggest slice of the pie goes to decarbonizing the U.S energy supply, followed by clean manufacturing and commercial buildings. Though the smallest slice goes to carbon removal, the scale of the bill is so large a $3 billion dollar investment essentially means that the government subsidy to remove one metric tonne of carbon increased from $50 to $85. Great news for fossil fuel companies looking to keep in business, though to be fair, also good news for essential manufacturing industries that are hard to decarbonize like steel and cement.

The vast majority of IRA funding goes to updating the electricity grid which intuitively makes sense since energy is the backbone of any civilization. What’s surprising to me though is that despite the majority of the U.S.A’s carbon emissions (28% of 2021 greenhouse gas emissions) coming from the transportation sector, it receives a relatively smaller slice of the pie. It may be due to the fact that decarbonizing the transportation industry would increase the overall energy demand because let’s face it, your electric car that gets electricity from a coal power plant would defeat the purpose. Another reason why the IRA focuses mostly on energy supply is because of an earlier historical record-breaking bill passed in November 2021. The infrastructure investments and jobs act includes the largest federal investment in public transit in history of $105 billion dollars. Another $110 billion is on fixing roads and bridges and includes measures for climate change mitigation and improving access for cyclists and pedestrians. I must admit, President Biden wasn’t a really inspiring candidate, but he did get stuff done.

In terms of how the money would be deployed to where it’s needed, Businesses tax Credits make up the majority of how the funds would be delivered to the active zones of this climate war. My first reaction to this is, ‘what an optimistic take on human nature!’ But the same way Universal Basic Income has been shown to have promising effects on reducing poverty and fostering economic growth, giving green to make businesses go green may actually be a strong strategy. Here is a list of credits and deductions under the IRA for both individuals and businesses.

Implications

Overall, the Inflation Reduction Act has done a lot of great things for the climate justice movement. Based upon 9 independent state of the art models, the IRA is on track to reduce U.S. greenhouse gas emissions to 43–48% below 2005 levels and produce more than 1 million solar and wind jobs by 2035. This makes me look at our goal of reaching net zero by 2050 not a pipeline dream, especially as more news comes out with our positive trajectory.

BloombergNEF’s predicts the U.S. clean energy sector is on track to deliver 600 gigawatts (GW) of solar, wind and energy storage capacity by the end of the decade. The report notes that the White House’s Inflation Reduction Act has contributed to this massive boom of renewable energy capacity. Assuming continuous output of one year, 1 GW can power up to 876,000 households for 1 year and the approximate average electricity consumption of the United States would be around 438 GW. This is a good starting point, but we’re going to have to climb higher to reach the summit. According to researchers, for the U.S to provide 94% of its energy for renewable sources, it’ll need 930 GW of power for 6 and a half hours of capacity.

A lot more solar and wind energy infrastructure will need to be added and improved upon if the U.S were to meet its climate goals. With 1 GW is equivalent to 3.125 million photovoltaic cells and 333 utility scale wind turbines, the whole decarbonization task looks a lot more daunting. Rather than curling up into a ball and crying, the U.S has started to make the manufacturing process of renewables easier, and more efficient, and it’s a direct thanks to the Inflation Reduction Act.

Renewable manufacturing is booming in the U.S with nearly 100 new facilities or factory expansions announced between August 2022 to May 2023, totalling over $70 billion in new investments. Much of the manufacturing in the U.S is gravitating to States in the South like Alabama, Georgia, and Texas. At least so far, most of the manufacturing investments look likely to go to communities represented by Republican lawmakers in Congress, all of whom voted against the Inflation Reduction Act.

One company, Enphase, opened its first manufacturing company in South Carolina leading the charge of Solar domestic manufacturing. They plan to open two more manufacturing sites this year where a total 1,800 jobs are expected to be created from the three locations.

Foreign based companies, excited to get in on the green pie, have accounted for more than half of the clean energy manufacturing announcements made and roughly two-thirds of the investment funds. Countries like South Korea, Japan, and China, are flocking to the U.S where the land fertilized by the IRA, will help them grow their battery manufacturing businesses. Japan’s Panasonic is preparing a site in Kansas for a $4B EV battery mega factory and Hyundai is looking to prepare their own $5.5B EV assembly and battery plant in Georgia.

Now the effects of this cannot be understated, and whether this is intentional or not is a bit fuzzy for me. If the U.S farts the whole world smells it and President Biden may have kickstarted a global decarbonization arms race. We’ve already seen how the generosity of the IRA is attracting hordes of companies to set up shop in the U.S. Many countries are accusing the U.S of protectionism and begrudgingly introducing their own policies to keep or attract green businesses.

The EU is looking to implement a 4 pillared strategy called the Green Deal Industrial Plan where the legislation aims to speed up clean tech permit acquisition, speed up access to funding, increase labor force for green jobs, and improve open trade. And Canada has revealed their own knock off version of the IRA, a $80 clean energy plan in the clean energy tax credits and infrastructure, to make sure their businesses won’t leave them.

Summary

I’ll admit, I went into this article with a fairly jaded lens, thinking that just throwing money at the problem would at best, barely treat the symptoms, and at worst, fund the problem itself. But my opinion has softened. This large piece of legislation was more far reaching than I initially thought. By making the U.S a manufacturing hotspot for green tech, they invite growth and prosperity back into their nation, incentivize and raises the bar for other nations to do the same, and helps create a spillover effect which will allow other nations to implement green tech at a lower price.

But we’re just getting started. For the following years to come, republicans we’ll continue to say republican’t and will try to repeal the IRA. Some democrats will push back against legislation that makes meaningful change based on their constituency. With all the money added to the green industry, engineers, construction workers, people from all walks of life will need to work together for us to reach net zero by 2050 and here are some IRA programs y’all can benefit from as we work towards that future.